family-happiness-generation-home-people-concept-happy-standing-front-house-outdoors

Aussie parents are delaying retirement to help kids buy first home

Veda Dante, September

2018

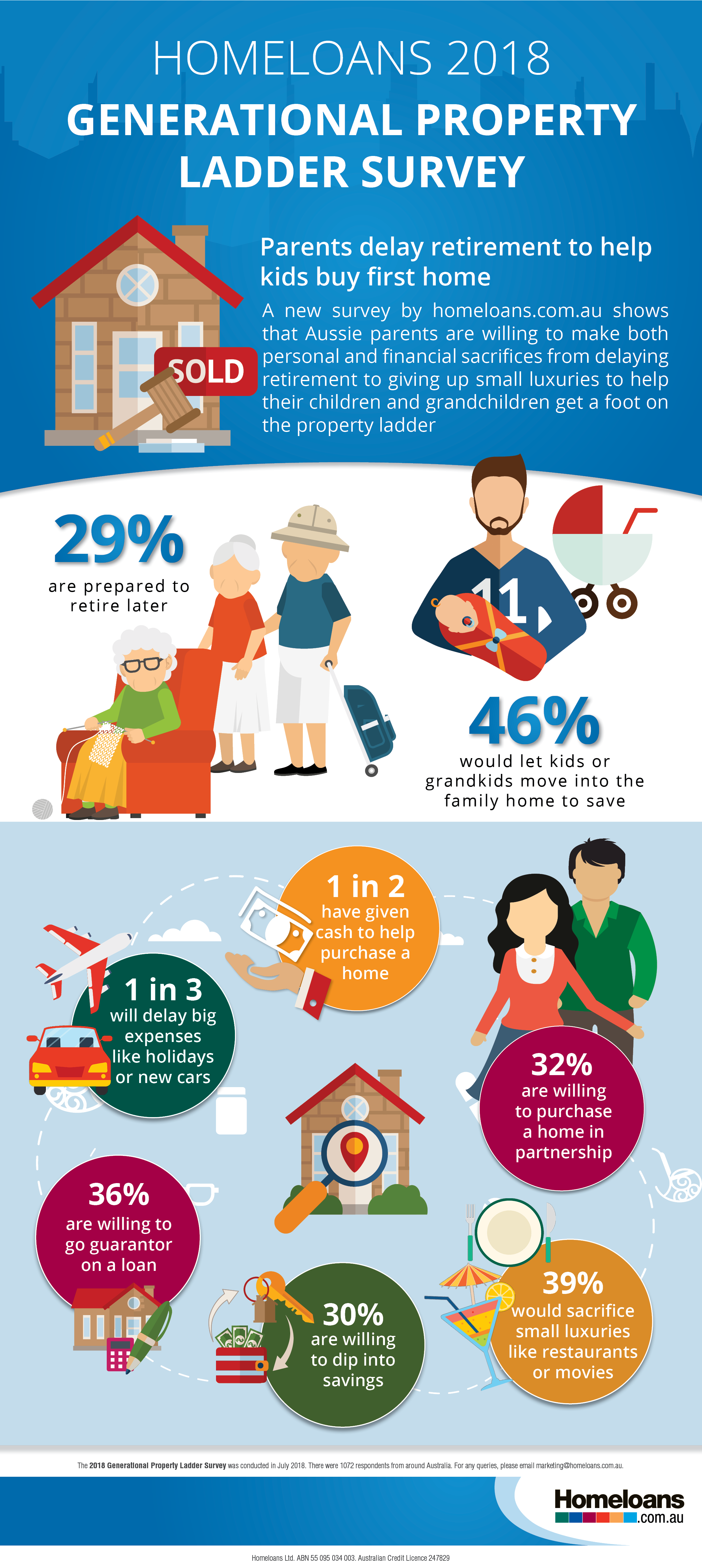

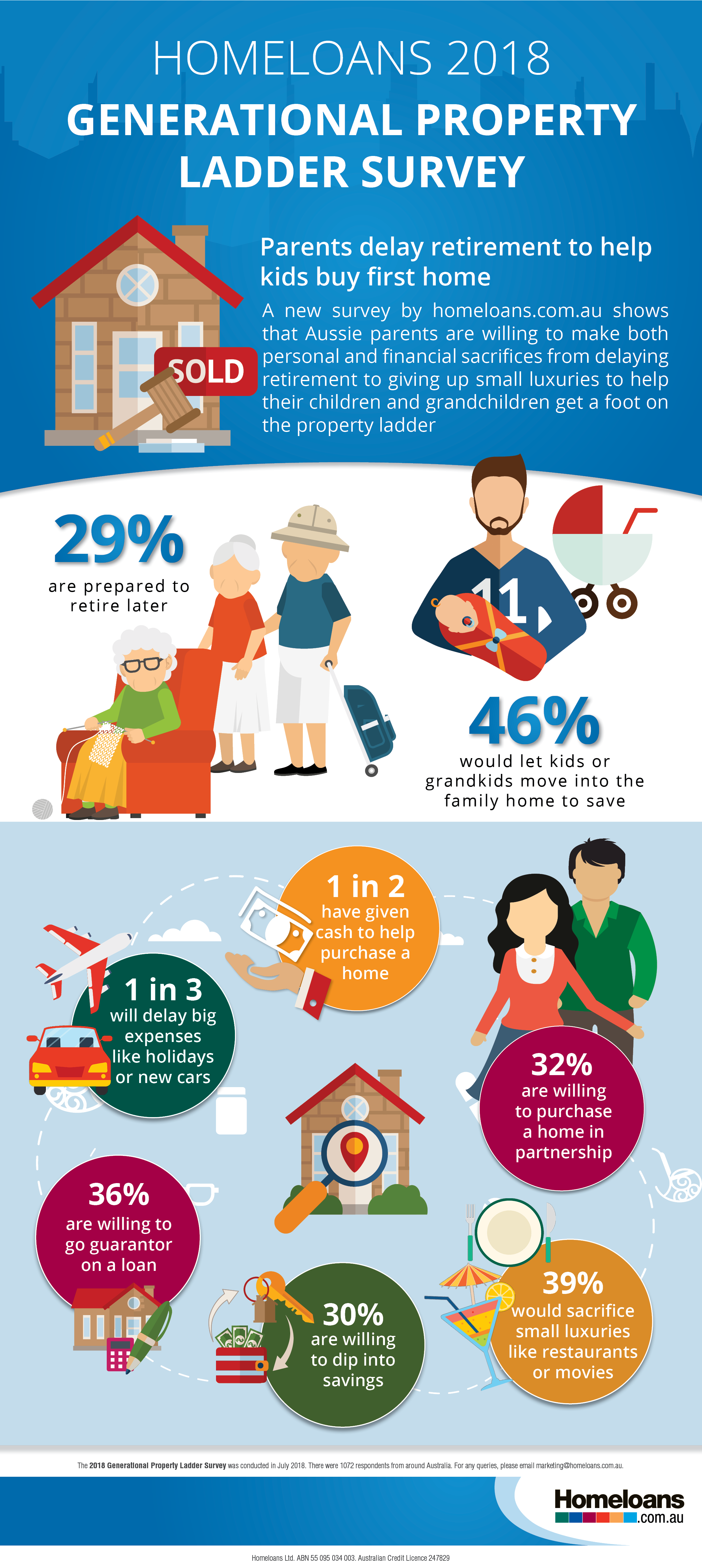

Australian parents are willing to do it tough, so their children (and grandchildren) can get a foot on the hard-to-reach property ladder, a new survey has shown. From delaying retirement, sacrificing luxuries such as a new car or a holiday, to dipping into their savings, parents are making both personal and financial sacrifices.

Homeloans’ 2018 Generational Property Ladder Survey reveals almost two in three parents (65%) are either currently making financial and personal sacrifices for their children and/or grandchildren to help them buy their own home, or plan to in the future.

Of those parents willing to provide financial assistance, more than a quarter (29%) are prepared to retire later than planned – which is aligned to recent reports by the Australian Bureau of Statistics (ABS) revealing a current trend of Australian’s retiring later despite a growth in superannuation.

Will Keall, Homeloans’ Head of Marketing, says the survey, which attracted 1072 respondents from around Australia, highlights the great lengths parents will go to, to make owning a home a reality for their children.

“Due to tougher mortgage lending standards it’s increasingly difficult for younger generations to break into the property market. To help with this, parents are doing what they can to help their children become first-home buyers, from cutting back on their own spending to going guarantor on a loan,” says Keall.

[caption id="attachment_10617" align="alignnone" width="690"] One third of respondents said they were happy to forego big expenses like overseas holidays to help their kids get into the property market.[/caption]

One third of respondents said they were happy to forego big expenses like overseas holidays to help their kids get into the property market.[/caption]

One third of respondents said they were happy to forego big expenses like overseas holidays to help their kids get into the property market.[/caption]

One third of respondents said they were happy to forego big expenses like overseas holidays to help their kids get into the property market.[/caption]

Sacrificing small luxuries and delaying big expenses

The survey shows that nearly two in five (39%) are willing to live more simply by sacrificing small luxuries like going to restaurants or movies, and a third (33%) are willing to delay big expenses like holidays or a new car. Just under one in three (30%) are willing to dip into their hard-earned savings to provide financial assistance, and one in ten (10%) are even willing to remortgage to free up cash. Around half of respondents (49%) have given cash to help their children or grandchildren buy a home and 16 per cent have provided an interest free loan. For those respondents looking to provide a boost, almost 60 per cent would consider a cash gift and 35 per cent an interest free loan. Others have helped by way of purchasing a home in partnership with their child, leaving an investment home in their will, or letting them stay at home to save money. More than 45 per cent of parents/grandparents would consider letting kids move into the family home while saving for a deposit. Keall says the survey reinforces that parents and grandparents are willing to do what it takes to help. “It’s commonly known how difficult it is for first-home buyers to get into the market, particularly in popular metro areas, and we’re seeing parents are prepared to go the extra mile for their children or grandchildren,” he says. “If parents are able to help financially by giving cash or going into partnership on a property, that is clearly the fastest way to help a first-home buyer onto a ladder. However, providing support to help your child save, such as by allowing them to move into the family home temporarily, or acting as guarantor on a loan will also help them to own a home sooner. “One idea for parents with adult children living at home could be to charge them board, and then invest the money to put towards a deposit. Not only does it give the kids a financial boost, it also helps them learn the discipline of saving.” The survey also found:- 36% are willing to be a guarantor on a loan from a financial institution

- 32% are willing to purchase a home in partnership with their children

- 46% would let them move into the family home while saving for a deposit

- 26% of parents that are currently providing assistance have dipped into savings to do so

- 13% have set up a trust fund for their children

- 39% would sacrifice little luxuries like going to restaurants or movie