What is a

Tax Scam?

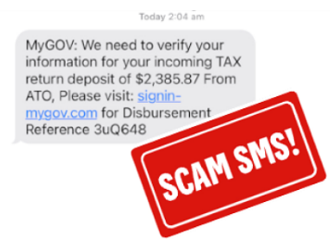

A tax scam is an email, phone call or SMS from someone claiming to be from the Australian Tax Office (ATO) or another government agency like myGov. You might be asked to give your personal details or make a payment and if you refuse, you may be threatened with arrest or legal action.

Tax scammers are more prevalent at the end of the financial year. Remember, be scam aware and never share personal or financial information, security codes or give anyone access to your devices.

Tax scammers are more prevalent at the end of the financial year. Remember, be scam aware and never share personal or financial information, security codes or give anyone access to your devices.

How to spot a

Tax Scam?

- Threats and urgency – Scammers put pressure on you to share personal details or pay immediately. The ATO won’t do this, so hang up and contact the ATO on an independently sourced numbers from the genuine website.

- Pretending to be trustworthy – Don’t click on links sent via SMS or email that take you to the ATO or other government websites. Always go to the website or app directly and check for messages.

- Unusual payments – if you are asked to pay using cryptocurrency, wire transfer, gift cards or to accounts other than the ATO, stay alert, this will be a scam. Always use payment details listed on an official letter, if you ever need to pay the ATO.

- Poor grammar and spelling – Look out for SMS or emails with poor grammar, spelling and check emails, links and phone numbers are legitimate.

How to protect yourself from tax scams:

- Do not click on any links or download attachments from suspicious emails or messages claiming to be from tax authorities.

- Report the incident to the appropriate tax authority. You can report it to the Australian Taxation Office (ATO).

- Contact your bank immediately if you suspect any fraudulent transactions or if you have inadvertently provided sensitive information.

- Educate yourself and others about the common signs of tax scams to prevent future occurrences.

- Check the official website of your tax authority for any alerts or updates on current scam tactics.

- Use official communication channels to contact your tax authority if you need to verify the authenticity of a communication.

- Keep your personal and financial information secure and be cautious about sharing it online or over the phone.